The Asia-Pacific insurance market is the second biggest market globally and is valued at about USD 1.8 trillion in gross written premium (GWP). Among the top 3 largest insurance markets globally are two Asian countries: China and Japan. In the life sector, the Asia-Pacific market is even the largest in the world and the insurance industry in the region is even expected to grow, mainly driven by China, India, and Singapore. Currently more than 70 % of premiums in the region are concentrated in three countries: China, Japan, and South Korea.

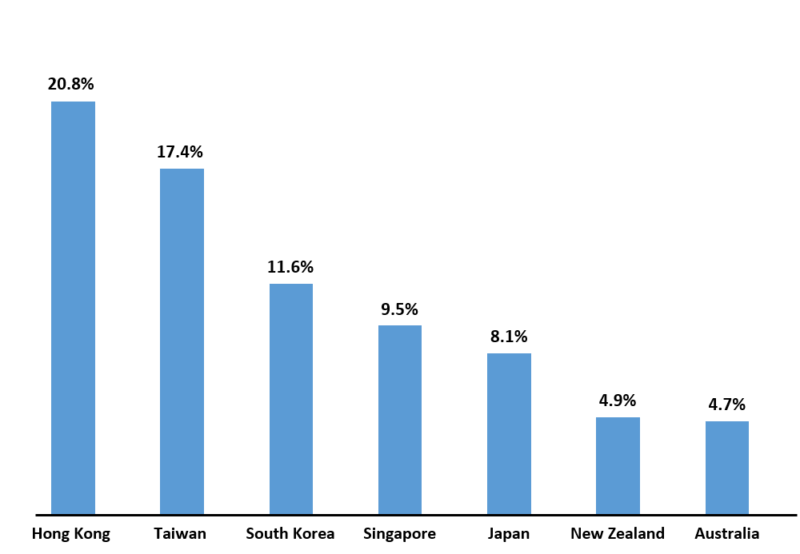

Share of gross written premium (GWP) by country in 2020

Source: Swiss Re Institute 2021

Source: Swiss Re Institute 2021

Diverse insurance landscape

Insurance markets in the Asia-Pacific region are quite diverse and are evolving rapidly because of fast economic growth and regulatory changes, though the markets have progressed very differently. This can be largely attributed to the different economic situations in the countries. A key characteristic of high-income-inequality countries, for example, is low financial inclusion, which typically equates to lower levels of insurance penetration (premiums as a percentage of GDP). Overall, both premiums and penetration have risen in the region. However, as their populations age, some mature markets have struggled, and consumer expectations shift.

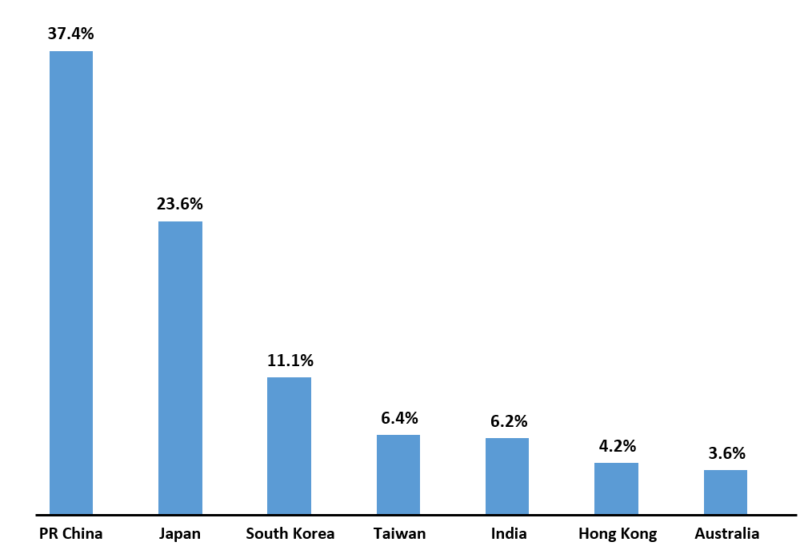

The penetration of insurance in the region is somewhat below the world average. Hong Kong, Taiwan, and South Korea are the most developed insurance markets in the region. By contrast, insurance penetration is less than 5% in India, Indonesia, mainland China, and Malaysia, far below Hong Kong, Taiwan, and South Korea. This signals a significant unmet demand in Asia-Pacific’s developing markets and indicates further future growth.

Insurance penetration (total GWP divided by nominal GDP) in Asia-Pacific by country in 2020

Source: Swiss Re Institute 2021