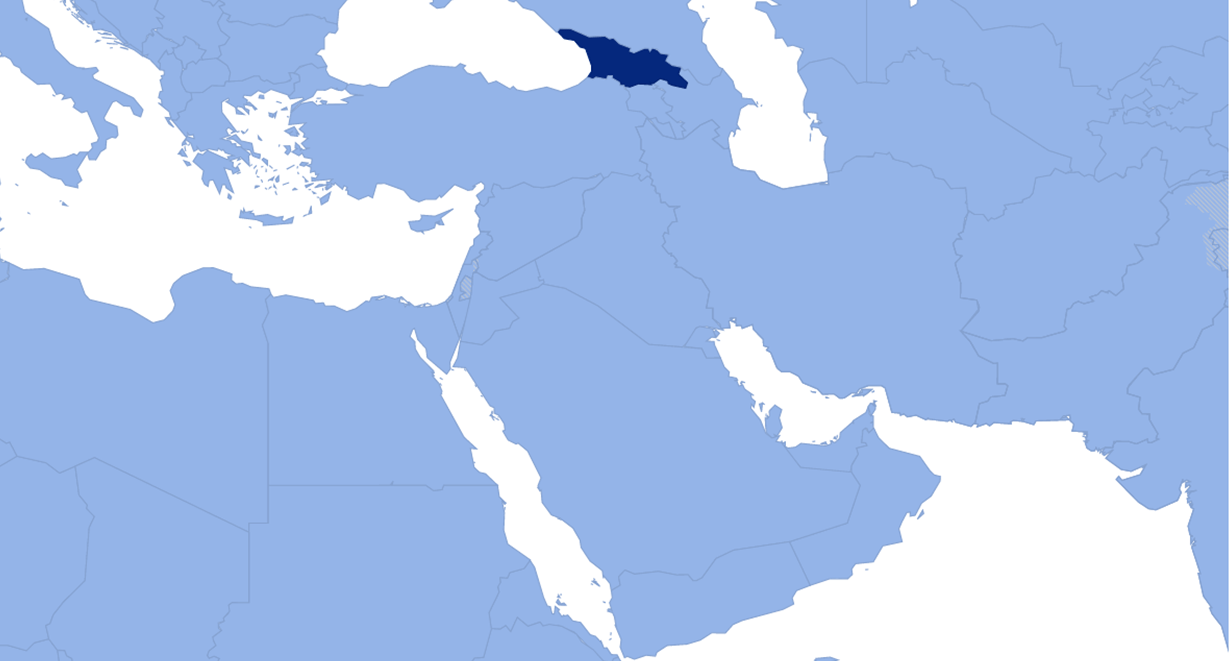

Georgia’s economy has grown significantly over the past decade, culminating in its recent classification as an upper-middle-income country. A small and open economy, Georgia has a population of 3.7 million and a land area of 69,700 km2. Georgia’s economic growth has been strong, with far-reaching reforms improving governance and the business environment. Between 2010 and 2018, the Georgian economy grew at an average annual rate of 4.8 percent, fueled by those reforms, by boosting exports and integrating with the regional and global economy.

Over the past two decades, Government focus has been to improve public service delivery and management by using digital technologies. It has led to the following results:

• Georgia now ranks seventh out of 190 nations in the ease of starting a business and fifth in registering property.

• It takes just one day to start a new business in Georgia, versus the worldwide average of 28 days and 8 days in Germany. It gives the country second place in the ranking. Georgians spend only one-day registering property, versus the worldwide average of 47 days and 59 days in Germany.

• Average wait times for construction permits and property registrations have fallen, respectively, from six months in 2005 to 63 days and from 39 days to 1.*

Georgia´s insurance market

2020 was a challenging year and has affected almost everybody. It has hit many companies, especially the ones in the hospitality business and aviation, who were forced to stop their activities for a very long period. Like a chain reaction, this has hurt Insurance Companies and brokers.

Although certain insurance lines, like travel insurance, have almost shrunk, overall, the market has grown by 6.8% YoY, and this is a significant achievement if we consider the worldwide impact of Covid-19. Most insurers have successfully adopted and changed their business model to cope with a given situation, ensure they continue their services, and provide clients with peace of mind.

In that aspect, the Georgian insurance market has reacted very well. Many of the insurance companies have developed special applications and accelerated their transformation to digitalization. That has assisted them in providing the clients with high-quality service. Some have changed their rules to make it easier for the customers to access and get the services. We also have to underline their flexible approach regarding the premium payment re-scheduling for those of our clients who had a severe financial impact and needed some time to cope with their situation. All our Insurers partnered and assisted in the best possible way.

Despite all the above, I still consider insurance a people’s business, and personal touch and face-to-face meetings are imminent and crucially important. We hope those days will return soon.

We have observed the international market hardening and capacity reduction in certain lines has seriously affected the local market. It was most significant in particular sectors and classes like, for example, Construction All Risks for large HPPs, where premiums increased almost 10 times. Also, insurances for financial institutions and Aviation continued to rise.

One crucial factor that saved local insurers – almost all clients who had purchased BI cover had their policies based on classical wordings where BI claim is payable following the claim on material damage section. In that respect, there were no Covid-19 related BI claims. The insurance market did not have the financial strength to deal with such a problem as none of the policies were considered such uncertain risk as Covid-19.

Georgia´s insurance market has seen significant growth over the past years. With the planned obligatory Motor Third Party liability law introduction, which was postponed several times and will probably launch next year Georgian market will grow further and become stronger.

Gross written premium (GWP) per year, million USD

Source: LEPL Insurance State Supervision Service of Georgia

Covid-19 and MAI Georgia Insurance Brokers

Like all market participants, we had to accept the new reality and adapt to changes. Almost everybody was working from home, which was quite difficult. At the beginning of the pandemic, there was nearly no border between the office and working hours. We have very close and friendly relations with our customers, and we did our best to assist them at all times. It became almost normal to have called even at late night. We assisted all our clients in their insurance needs, and as a result, we have successfully maintained and managed our portfolio. It is our team’s outstanding and hard work, and I would like to thank all of them.

Despite the fears of uncertainty, we have welcomed a new member in our team to lead SME Insurances, and we are pleased to see the first dozen new clients in that segment. So this can become an additional contributor to our portfolio growth.

We are proud to announce that we have managed to keep our leaders’ title and remain at the number one position within the Georgian Insurance Broker’s market according to 2020 results. MAI CEE as a group has also performed exceptionally well in 2020, and we are delighted to contribute to the overall result of the group.

The insurance brokers market has grown by 15% Year over Year. We are pleased to observe brokers are becoming more active players in the Georgian market, both in the Insurance and Reinsurance segments.

From the early days of the pandemic, we remained optimistic. The reality shows it will be challenging, but we must stay strong and adapt to all future changes. Our clients trusted us with their insurance needs, and we have to do our best to serve them. The Georgian market has vast potential. We are confident it will remain strong and create stability and peace of mind for all customers.

* World Bank