The new regulation will become effective per 31st of March 2025 and companies registered in Italy, including Italian branches of foreign entities, must secure Property coverages for natural disasters as of 31th of March 2025.

Who is subjected to take out the new insurance obligation:

All Italian companies as well as Multinational Companies with assets in Italy. Excepted are agricultural entrepreneurs.

Mandatory CAT NAT perils to be insured:

Earthquake, Flood as well as Inundation, Overflow and Landslide

Mandatory Property Risks to be insured:

Buildings (and related systems), Equipment (e. g. Contents / Machinery) and Property / Land.

| Sum insured (total for all insured locations) |

Min. Limits to be insured | Deductible – max. of the payable loss |

|---|---|---|

| up to EUR 1,000,000 | 100% | 15% |

| up to EUR 30,000,000 | 70% | 15% |

| from EUR 30,000,000 or for companies with a turnover exceeding EUR 150,000,000 and over 500 employees |

free to negotiate | free to negotiate |

| Property/ Land: |

Must be insured on a first loss basis (based on a pre-arranged value or limit), in porpotion to the area of the insured premises. |

|---|

| Machinery: | Includes industrial and commercial equipment (incl. Vehicles and transportation not regisered with the public motor registry P.A.R.) |

|---|

| Leased Locations: | It is not specified if the obligation to insure buildings fall on the Landlord or Tenant. Important to review which party contractually agreed to buy the insurance of the building and to check if the present insurance is compliant. |

|---|

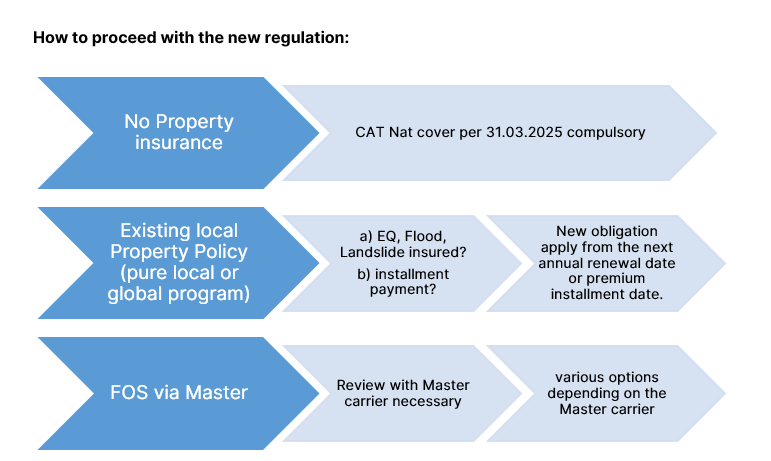

The insurance situation of each risk in Italy should be verified and eventually modified to be compliant with the new law. Insurance Carriers should provide according modifications to exiting policies or introduce stand-alone products.

What are the Sanctions:

In case clients do not comply with the new compulsory Cat Nat Law, they could face losing government financial incentives and grants.

If carriers are failing to provide a proposal, they could be charged with sanctions ranging from 100,000 EUR – 500,000 EUR. In any case it is not clear yet how coverage should be evidenced to demonstrate compliance.

We highly recommend to contact your Insurance Broker in Italy and / or your Insurance carrier (Master or pure local). In any case, the implementation of a local policy (pure local or Fronting) would help to be compliant with the local regulations and furthermore to be up to date with the local developments and requirements.

For further information, please contact us: info@trustrc.com